Your whole life insurance policy’s cash value increases every year, offering consistent growth no matter what’s happening in the market. It provides a stable and predictable way to build your savings over time. This guaranteed accumulation helps you reach your long-term financial goals without worrying about market volatility.

Secure Your Future With Whole Life Savings Strategy

Build Wealth, Protect Your Family, and Unlock Financial Freedom

Why Choose Prosperity Whole Life?

As an independent licensed life insurance agent, we’re not tied to one company. We work for you, finding the best whole life savings products tailored to your unique financial goals. Our expertise in Infinite Banking allows us to offer solutions that help you use your policy to fund major life events, from buying a home to financing your retirement.

Key Benefits of Whole Life Insurance

Guaranteed Growth

Tax Advantages

Whole life insurance offers tax-deferred growth, meaning your cash value can accumulate without immediate tax implications. Plus, when you borrow against your policy, those loans are generally tax-free. This allows your savings to grow more efficiently and provides a tax-advantaged source of funds when needed.

Financial Flexibility

Whole life insurance policies allow you to borrow against your cash value at any time, giving you easy access to funds for emergencies, investments, or large purchases. The loan does not disrupt your coverage or affect your death benefit, provided it’s repaid. This flexibility lets you leverage your policy as a financial tool while maintaining its benefits.eases.

About

With over 10 years of experience in the insurance industry, I’ve dedicated my career to helping individuals and families secure their futures and achieve financial peace of mind. My background spans both whole life insurance and health insurance, allowing me to provide comprehensive guidance that covers your life and health protection needs.

My mission is simple: to educate and empower you to make informed decisions that benefit your long-term financial well-being. I take a personalized approach to each client, helping you understand the complexities of insurance and tailoring solutions that align with your specific goals. Whether it’s building wealth through whole life insurance, planning for a secure retirement, or finding the right health coverage, I’m here to guide you every step of the way.

Your financial security is my priority, and I look forward to helping you create a plan that provides confidence, security, and a bright future. Let’s work together to protect what matters most and build a strong financial foundation for the years to come.

Unlock the Wealth-Building Power of Whole Life Insurance – Discover These Game-Changing Strategies Now!

Whole Life Insurance: The Secret to Lifelong Financial Security

Whole life insurance is more than just coverage for your loved ones—it’s a powerful financial tool that can provide security throughout your entire life. This article explores how whole life insurance combines both protection and savings, offering guaranteed cash value growth that can be accessed at any time.

Grow, Protect, and Prosper: How Whole Life Insurance Builds Your Wealth

Building wealth isn’t just about taking risks in the stock market—whole life insurance offers a reliable, guaranteed way to grow and protect your money. This article dives into how whole life insurance acts as both a savings account and an investment, growing your wealth steadily over time.

Beyond Coverage: The Surprising Benefits of Whole Life Insurance You Didn't Know

When people think of whole life insurance, they often only consider the death benefit—but there are many more benefits hidden in this powerful financial product. This article sheds light on the lesser-known advantages of whole life insurance, from policy dividends that can boost your cash value to the ability to borrow against your policy for financial flexibility.

Whole Life Insurance: The Secret to Lifelong Financial Security

Whole life insurance is more than just coverage for your loved ones—it’s a powerful financial tool that can provide security throughout your entire life. This article explores how whole life insurance combines both protection and savings, offering guaranteed cash value growth that can be accessed at any time.

Grow, Protect, and Prosper: How Whole Life Insurance Builds Your Wealth

Building wealth isn’t just about taking risks in the stock market—whole life insurance offers a reliable, guaranteed way to grow and protect your money. This article dives into how whole life insurance acts as both a savings account and an investment, growing your wealth steadily over time.

Beyond Coverage: The Surprising Benefits of Whole Life Insurance You Didn't Know

When people think of whole life insurance, they often only consider the death benefit—but there are many more benefits hidden in this powerful financial product. This article sheds light on the lesser-known advantages of whole life insurance, from policy dividends that can boost your cash value to the ability to borrow against your policy for financial flexibility.

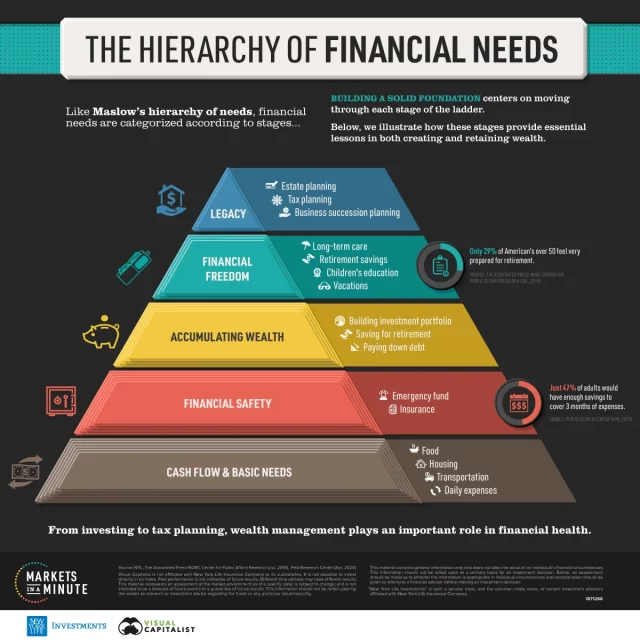

Our Financial Model

Whether you’re just exploring whole life insurance or ready to take control of your financial future through Infinite Banking, we’re here to help. Schedule your free consultation today, and let’s build a personalized strategy that works for you.